WHAT IS A CREDIT SCORE?

If you’re like most people you understand the basics of how credit scores are developed. Paying your bills, including mortgage payments, auto loan payments, credit card payments, and loan payments on time help you to establish good credit. However, understanding what causes bad credit is a bit more challenging.

Your overall credit score is based on a number of factors, including how many credit accounts you have open, how long you’ve had credit, what types of credit you’ve used, the debt to available credit you have, revolving credit, and many more items. While it is not imperative that you understand exactly how each of these factors affects your credit, it is important that you understand that paying bills on time, keeping the amount of money you owe to a manageable level, and making sure that you regularly check your credit, is vital to achieving and maintaining a good credit score.

WHY GOOD CREDIT MATTERS?

WHY GOOD CREDIT MATTERS?

Lenders use your credit report in order to judge your reliability as a loan candidate. Your credit report demonstrates your ability to handle debt responsibly and will help banks decide if you are a desirable loan customer. A high credit score can help you lock in low interest rates or secure special deals on loans. A low credit score on the other hand may prevent you from securing loans thus compromising your ability to buy a car, open a credit card, rent or buy a home. A history of inability to manage your credit successfully will make lenders uncomfortable about trusting you with additional funds in the future. If they do lend you additional funds in the future, you will almost certainly pay a higher interest rate than a borrower with good credit.

WHAT MAKES UP A CREDIT SCORE?

WHAT MAKES UP A CREDIT SCORE?

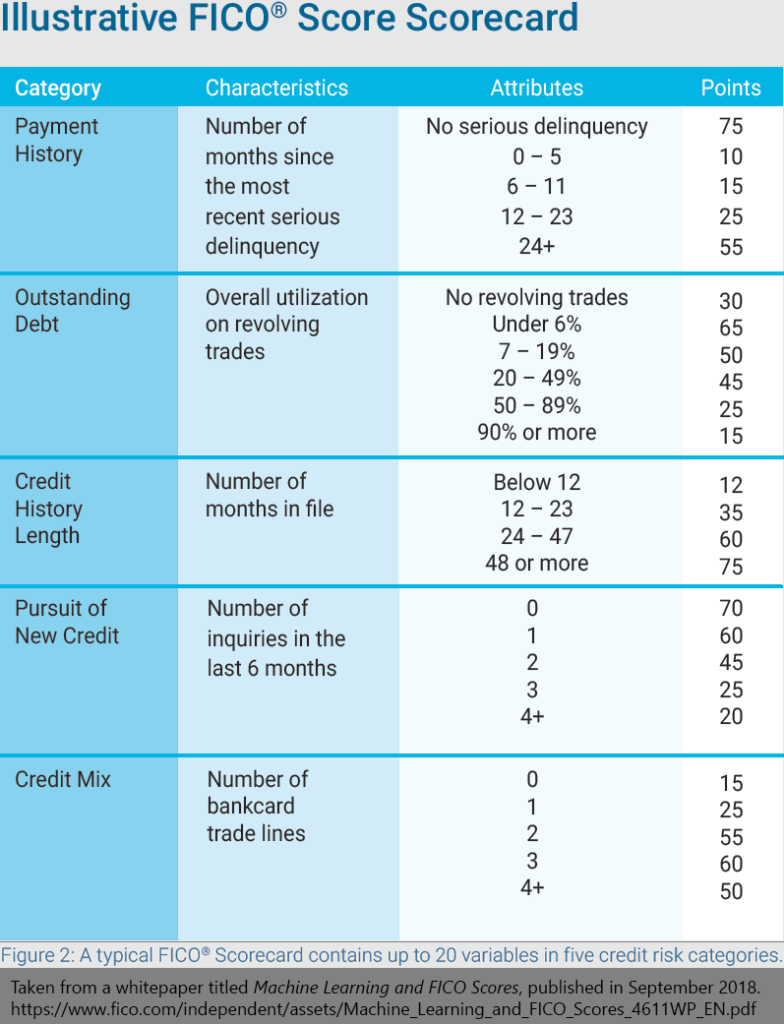

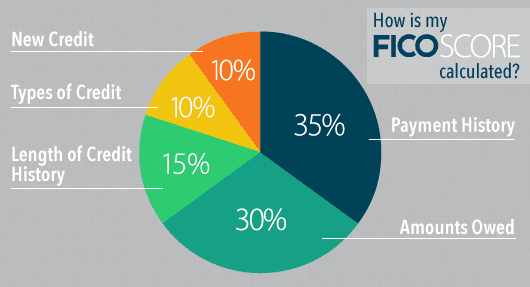

Thirty-five percent of your credit score is made up by your payment history. This includes late payments, collections, bankruptcies and tax liens. Each type of account will stay on your credit report a specified period of time and each type of derogatory will hurt your score differently. Rich Black & Associates works to remove accounts that are reporting negative, closed, derogatory, or delinquent on your credit files.

PAYMENT HISTORY

This is your FAQ Answer. Make sure your writing is clear and concise. It’s a good idea to review what you’ve written and ask yourself the following – if this was my first time visiting the site, would I fully understand this answer? Then revise or expand as necessary. Consider adding a photo or video as a visual tool or for extra impact.

DEBT RATIO

Your debt ratio is the amount of revolving credit (i.e. credit cards) you owe in relation to the amount of credit you have available. For instance, if your credit limit is $10,000 and your current balance is $2,000, your debt ratio would be 20%. While, ideally, you would have your debt ratio at 0%, we usually recommend you are at least at 30% or lower.

LENGTH OF CREDIT

Your length of credit is how long you have had credit. At face value, this seems like something you couldn’t really do anything to fix. However, there are ways you can hurt yourself here. If you close out your older cards, even if they have higher interest rates, it will hurt your score. The credit scoring model has no memory or credit cards you close: if you close out that fifteen year old card you will receive no credit for it!

TYPES OF CREDIT

Types of credit include revolving, installment and mortgage loans. By having different kinds of credit open, you show creditors that you are responsible and able to handle different kinds of responsibilities.

INQUIRIES

Inquiries are marked on your credit report when you ask for new credit (i.e. when you apply for a home loan, credit card, auto loan, or a line of credit). Inquiries made by yourself or for unsolicited offers do not count against your score, but are shown on your report. Multiple, ongoing inquiries will have a negative effect on your credit score, even if you are shopping for a car or a home. When you are looking for a home loan, or an auto loan, multiple inquiries within 45 days will also lower your credit score.