You can sign up for our credit restoration program with zero upfront fees. You can feel comfortable knowing that we will not charge you for the Initial Audit Fee until 5 days after you enroll.

Below are the services included in our Initial Audit:

If we are unable to delete any negative items from your credit report.

Our clients must also maintain an active credit monitoring service from all three credit bureaus. If the client doesn’t already have one, we will have them sign up for our preferred credit monitoring site.

Inaccurate Personal Information

We want to make sure that the credit bureaus are reporting 100% accurate information. You don’t have to have someone else’s name or address on your credit report. This can cause a credit merge and a possibility of their items jumping onto your credit report. We work to remove the following:

We realize that you might have late payments on your credit report. We contact the credit bureaus and creditors to demand they are reporting 100% accurate information pursuant to the Fair Credit Reporting Act (FCRA) and the Fair Credit Billing Act (FCBA). Late payments appear due to:

Collection accounts can seem to be very burdensome and you may not know exactly what rights you have. We will never suggest for you to not pay a collection agency, but before you do, ensure that they provide proper validation and are able to prove the account is yours. There are times where collection agencies report inaccurate information on your credit report so it is their responsibility to provide verification that the accounts is reporting accurate. They must do the following:

A charge-off occurs when your account typically goes over 180-past due and the creditor has closed your account. They then will either two things, hire a collection agency to collect the debt or file a judgment against you. Just like with any other account, the account must be listed 100% accurate on your credit report. We will ensure the creditors do the following:

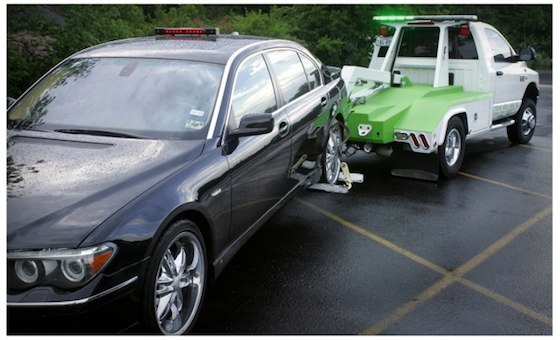

No one likes it when their car is repossessed. By we don’t want you to feel that you are never able to recover. Creditors and credit bureaus must report accurate information on your credit report. As well as provide documentation that supports any information reported. Lenders must do the following:

A foreclosure can prevent you from being approved for credit again. But knowing how to request validation or verification can be the key to proper removal. Banks must do the following:

Public records can cause your credit score to drop significantly. Courthouses do not report to the credit bureaus either so ensuring that you get the proper documentation to remove these accounts are important. We can dispute the following inaccurate public records: